Online Personal Loans up to $10,000

Get back to your happy place fast. Apply in minutes.

It's easy to meet your needs with a personal loan.

Apply

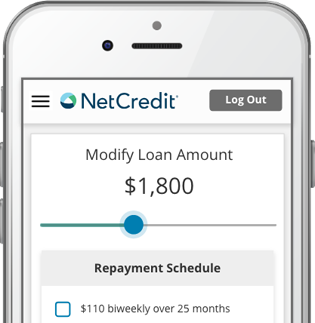

The secure loan application takes just minutes. If you’re eligible, you’ll be able to customize the amount you borrow and your repayment schedule.

Get Funds

If approved, your money can be in your account the next business day or sooner.

Repay

We report your payments to major credit bureaus, meaning you can build credit history with on-time repayment. You can repay early at any time with no penalty.

What can your personal loan give you?

Flexibility

With a personal loan, you can customize your loan amount and duration before you sign your contract, making sure you get what you need.

Credit Growth

Your account activity is reported to credit bureaus, so on-time repayment may help you build your credit and your financial future.

Confidence

NetCredit is owned by Enova, a publicly traded company (NYSE:ENVA), and has been helping customers meet their financial needs for more than a decade.

What do I need to apply for a personal loan?

You must be 18 or older.

You must have a valid personal checking account.

You must have an active email address.

You must have a verifiable source of income.

This won't affect your credit score.

FAQ

A personal loan is one way for an individual consumer to borrow money. Personal loans are typically structured as installment loans, which are paid off over a defined period of time. The loan amounts and terms can range broadly, depending on the state and the lender.

Typically, the borrower receives a lump sum payment (the principal) from a lender and pays it back at a cost (interest rate plus any loan fees). For personal loans with an origination fee, the fee is often deducted from the principal loan amount, so the amount advanced to the borrower is the principal loan amount minus the origination fee. The borrower will typically repay the entire principal loan amount, which includes the origination fee. Payments are made in regular installments over the term of the loan. Many personal loans are unsecured loans, which means they do not require the consumer to pledge an asset (like a home or car title) as collateral.

The interest rates for these personal loans are generally set by the lender and can vary depending on factors such as the borrower’s creditworthiness and the size and duration of the loan requested. Rates will usually be fixed for the life of the loan and calculated as an annual percentage rate (APR).

Personal loans are used mainly for personal, family or household purposes, such as to cover unexpected expenses, pay for large home or auto purchases, or to consolidate debt.

To determine how much you may be eligible to borrow, fill out a quick online form to check your eligibility or call one of our customer support representatives today for more information.

NetCredit personal loans range from $1,000 to $10,000, but your eligibility will depend on your state of residence and your creditworthiness. If approved, you can customize your loan amount before signing.

For more information about the loan options in your state, please visit the Rates & Terms page.

Approved applications are typically funded the next business day. Applications submitted before 11:00 a.m. CT Monday – Friday may be funded the same business day. Approval is subject to additional verification, and failure to provide additional documentation promptly may delay funding.

Alabama, Alaska, Arkansas, Arizona, California, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin and Wyoming

Your repayment period will vary depending on which state you live in, but you can generally expect anywhere from 6 to 60 months. You'll receive a lump sum and have a fixed rate and regularly scheduled repayments, so you'll always know exactly how much you're paying.

If you're looking for a little more financial flexibility, but with a more variable repayment schedule, a NetCredit line of credit might be a better fit.

One of the great things about personal loans is the ability to use it for any number of things. You could use the money for bills, debt consolidation, moving costs, car repairs and many other expenses.

Checking your eligibility will not affect your credit score. We use what's called a "soft pull" — as opposed to a hard pull — to determine your eligibility and get you the best offer possible. Soft pulls do not affect credit scores.

However, if you're approved for a loan and sign a contract, there is a hard pull that may temporarily affect your credit score. This hard pull only happens after the contract is signed, and you can build credit history by making on-time payments.

If you have more questions or would like more information, please visit the FAQ page.

Trusted by thousands of people like you.

This won't affect your credit score.