Inflation has been a high-pressure issue for Americans since the outbreak of COVID-19 — and despite being long out of lockdown, consumers continue to shop strategically as the cost of living rises.

By August 2024, consumer prices remained 22% above pre-COVID levels, and the majority of Americans were “very concerned” about the price of food and goods. And inflation has continued to rise well into 2025, leading American families to further tighten the purse strings.

But how your home budget adds up can depend very much on the prices and wage levels where you live. To help you picture this, online lender NetCredit created a cost of living calculator. We also compared local entry-level job wages to local costs of living using MIT’s Living Wage Calculator and ranked states and cities based on the percentage of job ads offering salaries above the local living wage. Read on to see what we found.

Cost of Living Calculator

The “cost of living” is a calculation of how much money you need to cover your basic necessities. These essentials may include housing, food, child care, health care, reasonable leisure costs and other regular expenses.

Many of these costs can vary considerably depending on where you live. So, NetCredit’s cost of living calculator balances your own personal figures and location against regional cost variations to give an accurate idea of how your expenses might change were you to relocate to a specific metropolitan area. You can use these figures to see how much you might need to earn to thrive in a specific city or even to negotiate your salary with a new employer.

(Please note: In families with two adults, where one is not working, our calculations assume that the unemployed adult is providing childcare responsibilities at no additional cost.)

Report findings

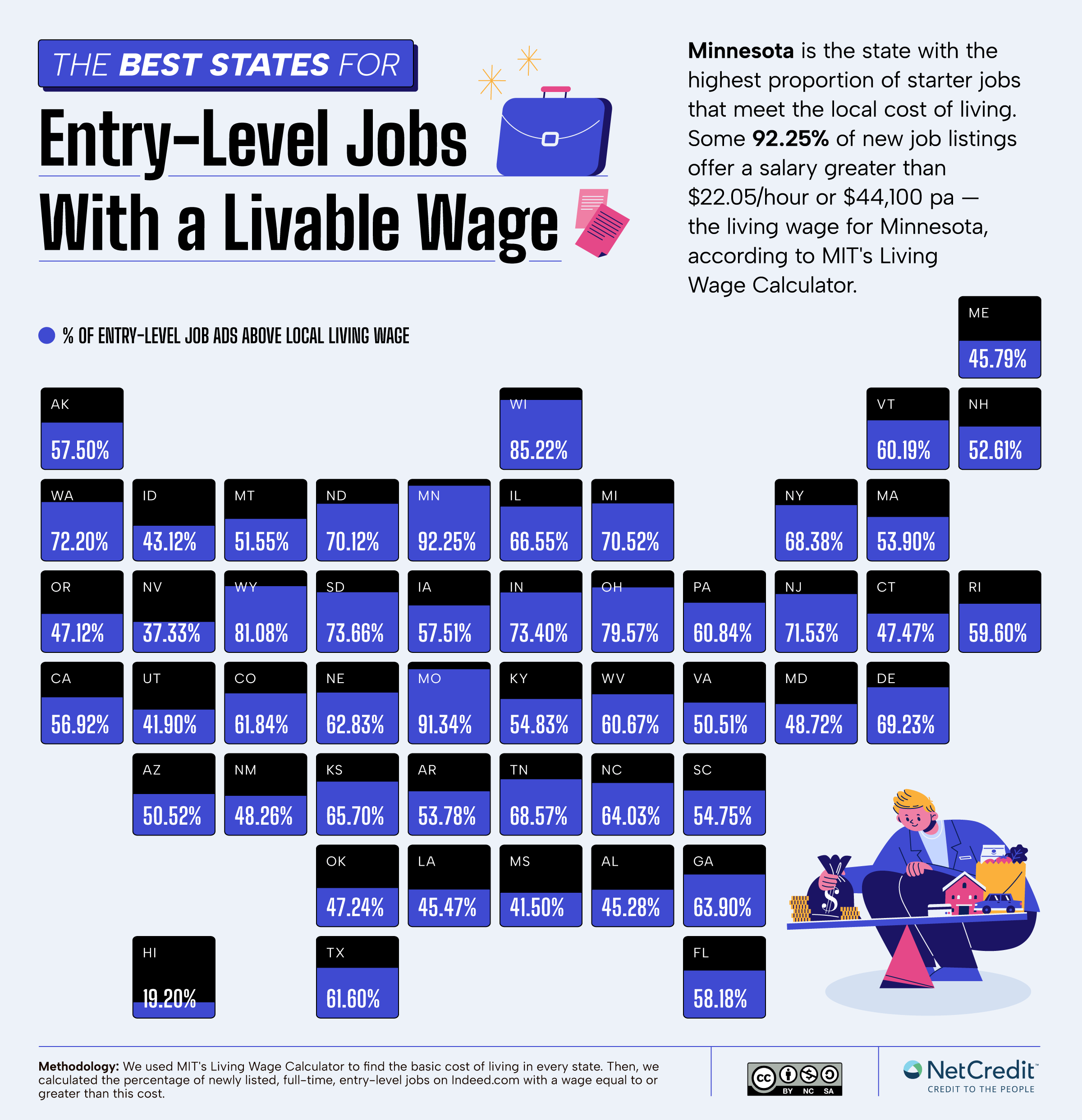

- Minnesota is the best state to earn a living wage, with 92.25% of entry-level jobs meeting the local living wage of $44,100.

- In Hawaii, just 19.20% of entry-level jobs offer a living wage ($59,840).

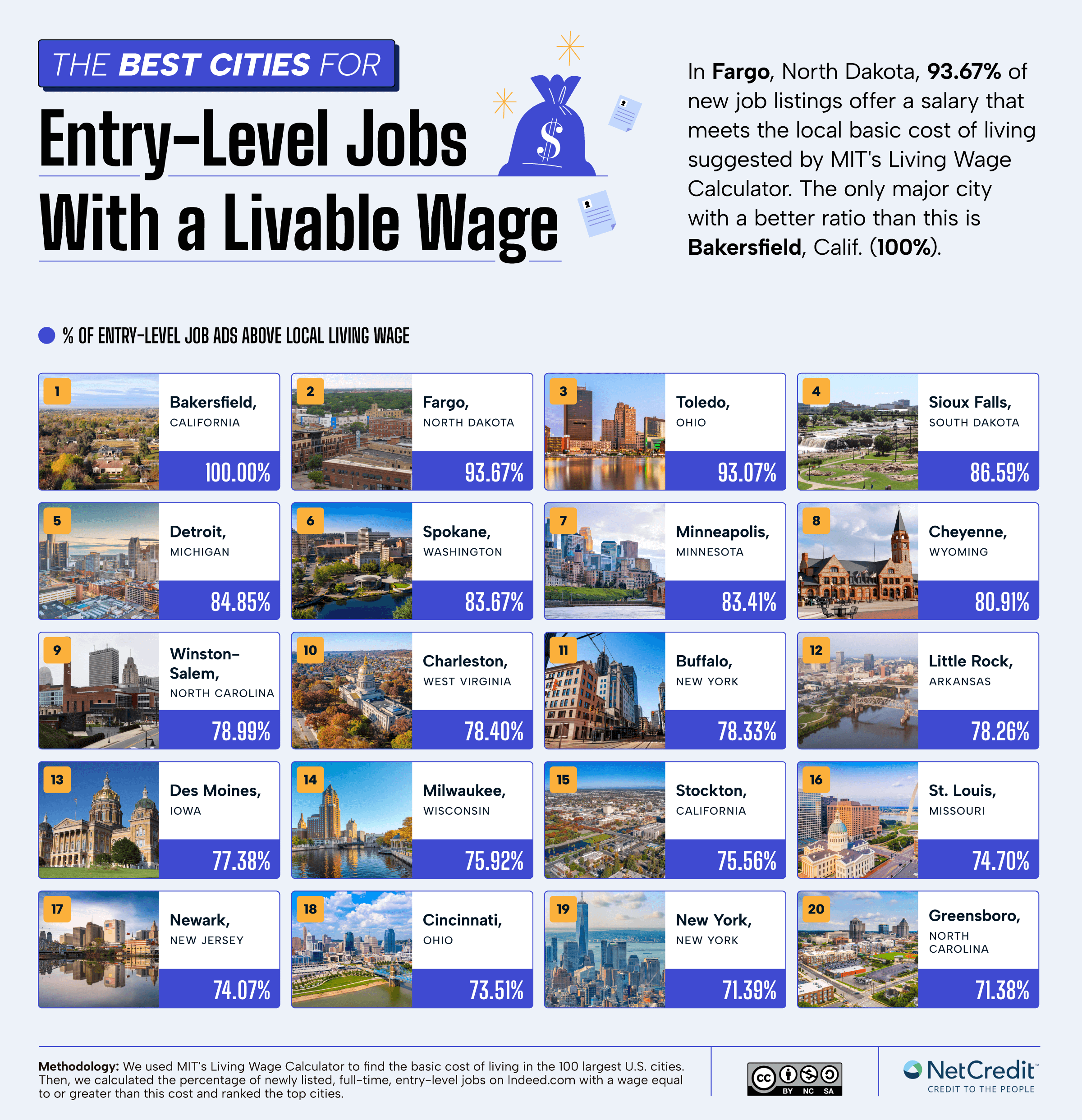

- Every entry-level job (100%) in Bakersfield, Calif., meets the local living wage — the only major U.S. city where this is the case.

Nine out of ten entry-level jobs in Minnesota meet the cost of living

In Minnesota, some 92.25% of entry-level job vacancies come with a wage greater than $22.05/hour or $44,100 pa — the amount MIT’s Living Wage Calculator suggests locals need to cover the living costs. This makes Minnesota the best state for securing a job that satisfies the local living wage.

In 2018, Minnesota state law changed to say that the minimum wage across the state should rise annually with the cost of living. While the present minimum wage — $10.57/hour — remains far below MIT’s suggested living wage, it is likely to buoy the salaries of those earning above the minimum wage.

At the other end of the scale, fewer than one in five (19.20%) new entry-level jobs in Hawaii satisfy the local cost of living. MIT puts the Hawaiian living wage at $29.92/hour, or $59,840 pa, which is 3.6% higher than the next most expensive state, Massachusetts. However, in Massachusetts more than half (53.90%) of new entry-level jobs match this figure. Around 37% of households in Hawaii have considered leaving the state due to the cost of living, according to community organization Aloha United Way.

Every new job in Bakersfield, Calif., meets local living wage

Next, we gathered data for the metropolitan areas of the 100 most populous cities to determine the best and worst cities for living wage jobs. In Bakersfield, Calif., every entry-level job listed on Indeed for our data period satisfied the local living wage of $22.67/hour suggested by MIT’s Living Wage Calculator.

Bakersfield’s 100% record is a decent leap above the next best cities, Fargo, N.D. (93.67%) and Toledo, Ohio (93.07%), despite these cities’ relatively low living wage ($18.74 and $19.50 respectively). In Fargo, this suggested living wage is far above the actual minimum wage, which is set at the federal level of $7.25.

“If there is even one employer out there in the state that is still paying minimum wage, I encourage them to do the math and see what they are living on per year, and let’s do something,” said North Dakota State Rep. LaurieBeth Hager.

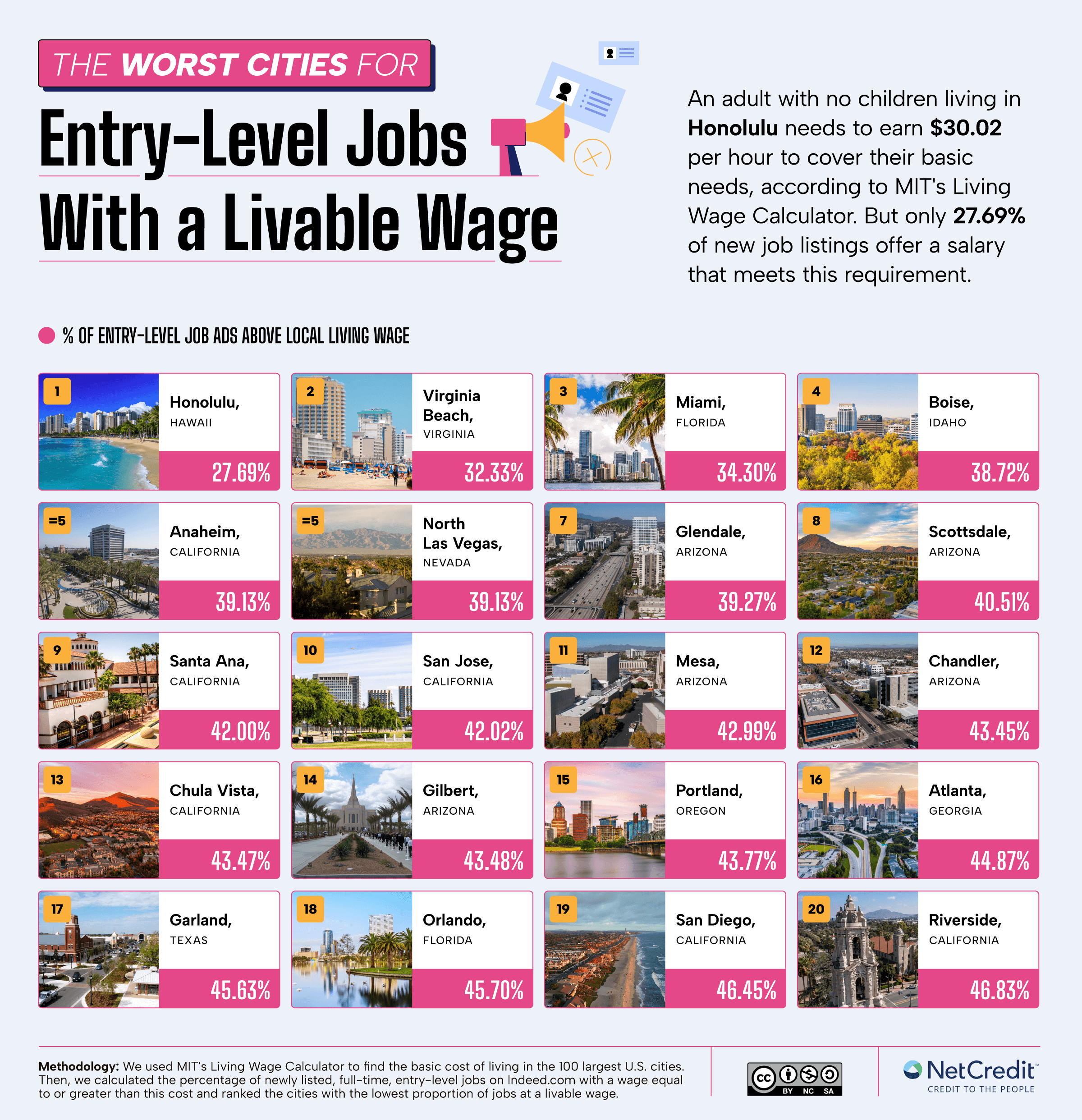

At the other end of the scale, just 27.69% of new entry-level jobs in Honolulu meet the local living wage of $30.02/hour. Honolulu is joined among the 20 worst cities by six Californian and five Arizonan cities.

Some 56.92% of California’s entry-level jobs meet the statewide Living Wage of $28.72. However, California has the fourth widest income disparity of any state. So even when the cost of living remains comparable from city to city — such as Chula Vista and San Diego — the jobs available may be pegged at a different level. In both cities, the living wage is $30.71, but in Chula Vista, just 43.47% of jobs meet this level compared to 46.45% in San Diego.

Four tips for balancing your home budget

You can take much of the worry and the waste out of managing your regular expenses by facing up to the issue and taking strategic measures to stay on track. Here are five ways to help steer your income through the current economy.

1. Make a budget

The first step in balancing your budget is to make a budget. Try following the consumer.gov guidelines and worksheet to track your expenses, plan ahead and then check back to see how your spending measures up against your intentions.

2. Prioritize your debts

Being short of money can soon get expensive when debts add up, bringing interest costs and late payment fees. Prioritize paying high-interest debts first, and always speak to your lender if you think you might miss a payment — they may be able to help you avoid incurring extra costs.

3. Downsize your home

Housing eats up the lion’s share of most people’s monthly income through rent, mortgage payments and utility bills. If you can manage in a smaller home, you may enjoy lower rent or mortgage costs while also minimizing utility bills. An alternative, if you have a spare room, is to rent it out to a lodger or on Airbnb. Beware of scams and potentially dangerous situations when renting out your home.

4. Find a side hustle

Earning an extra $50 here and there on the side of your regular job can make all the difference at the end of the month. Check out our guide to the most profitable side hustles on the internet, but be aware that making serious money this way often involves more time and commitment.

Final thoughts

It can be frustrating to rein in the spending just when you’ve joined the world of work — but the many entry-level jobs fail to meet the cost of living requirements calculated by MIT’s economists. Still, this reflects a broader trend of careful budget management across the U.S.

“Purchase volumes have gone down across the industry as consumers across all income groups become more thoughtful about spending,” as Max Axler, chief credit officer of consumer finance company Synchrony Financial, tactfully put it.

But with local wage levels and costs of living in flux, for some it also makes sense to look at where else in the country they might get a better deal for their day’s work.

Methodology

We ranked states and cities based on the percentage of job ads that offered salaries above the local living wage.

To define the living wage by location, we found the cost of living for one adult (without children) by metro area and state using MIT’s Living Wage Calculator: https://livingwage.mit.edu/. We identified the 100 most populous cities in the U.S. (and the most populous by state) and then mapped the cities to their corresponding metro areas.

We then used Indeed.com to find the number of new entry-level jobs in each location, using the filters to isolate only full-time, entry-level jobs posted in the past week. This allowed us to compare the percentage of entry-level jobs in each location that met the local living wage as defined above.

This data analysis was completed in February 2025.

DISCLAIMER: This content is for informational purposes only and should not be considered financial, investment, tax or legal advice.