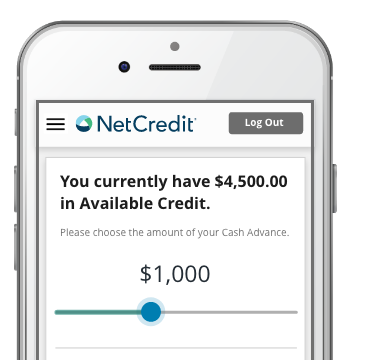

Line of Credit up to $4,500

Don’t let surprise expenses throw off your groove.

It's easy to get money with your personal line of credit.

Apply

The secure application takes just minutes. Depending on your application, you could be approved for a line of credit of up to $4,500.

Get Funds

You can take a Cash Advance from your Available Credit whenever you need funds. You’ll get your money the next business day or sooner, after your Cash Advance Fee is deducted.

Repay

You’ll have a Minimum Payment each Billing Cycle, which includes a portion of your Cash Advance Balance plus a Statement Balance Fee. Your payment history is reported to major credit bureaus, meaning you can build credit history with on-time minimum repayments.

Head to the Rates & Terms for more details and to learn what is offered in your state. For a full list of terms and definitions, visit the Line of Credit glossary page.

What can your personal line of credit give you?

Flexibility

With a line of credit, you can get the money you need up to your credit limit, repaying only based on what you’ve borrowed.

Rewards

Qualifying account activity can unlock rewards that make your line of credit more flexible to pay back and more affordable to get money when you need it. For more information on Skip-a-Pay and Fee Saver rewards, visit the Line of Credit Rewards page.

Confidence

NetCredit is owned by Enova, a publicly traded company (NYSE:ENVA), and has been helping customers meet their financial needs for more than a decade.

What do I need to apply for a line of credit?

You must be 18 or older.

You must have a valid personal checking account.

You must have an active email address.

You must have a verifiable source of income.

This won't affect your FICO® score.

Frequently Asked Questions

Initial Application

Initial Cash Advances for approved applications are typically funded the next business day. Applicants who submit an application before 11:00 a.m. CT Monday – Friday and request a Cash Advance may receive their funds the same business day. Approval may be subject to additional verification. Failure to provide additional documentation promptly may delay funding.

Open Lines

If you have an active line of credit and request a Cash Advance between 12:00 a.m. and 12:00 p.m. CT, you'll typically receive your money the same business day. Cash Advance requests after 12:00 p.m. CT are typically funded the next business day. If you request funds over the weekend, you'll typically receive your money the following Monday. Keep in mind that the exact funding time will depend on your bank. If there’s any delay, don’t hesitate to inquire with them.

Trusted by thousands of people like you.

This won't affect your FICO® score.