It’s never too early — nor too late — to start planning your retirement finances, and getting started can ease your mind and contribute to a more satisfactory outcome. While a recent survey suggests that Americans’ confidence in their retirement prospects is dwindling, 70% of retirees claim to have saved and planned suitably for a comfortable retirement.

However, analysis by the National Council on Aging and specialists at UMass Boston suggests that around 80% of households with older adults are “either financially struggling now or are at risk for economic insecurity in retirement.” The issue is particularly pressing for women, who have lower retirement, pension and social security income than men on average and are more likely to rely on Social Security as their main source of retirement income.

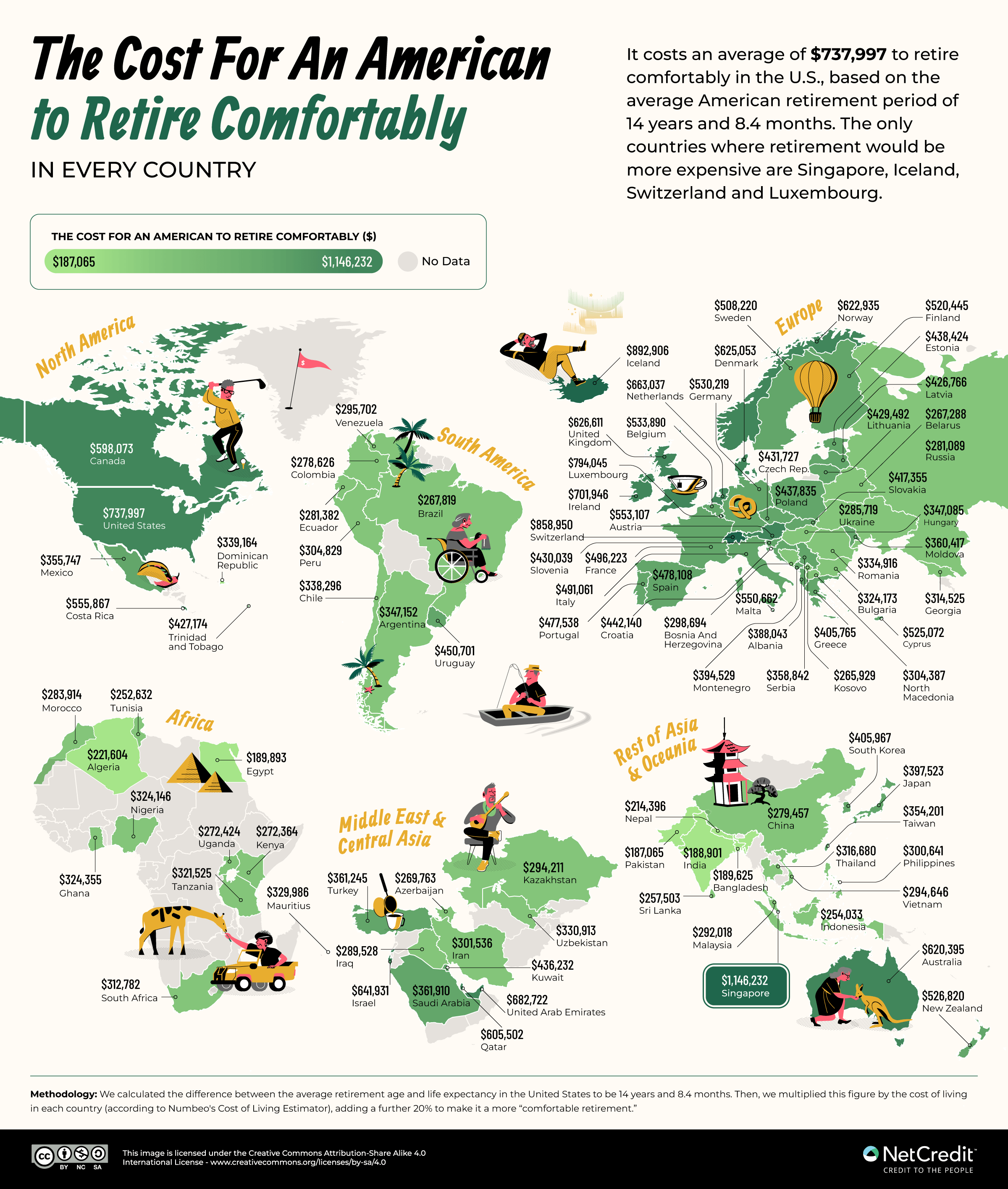

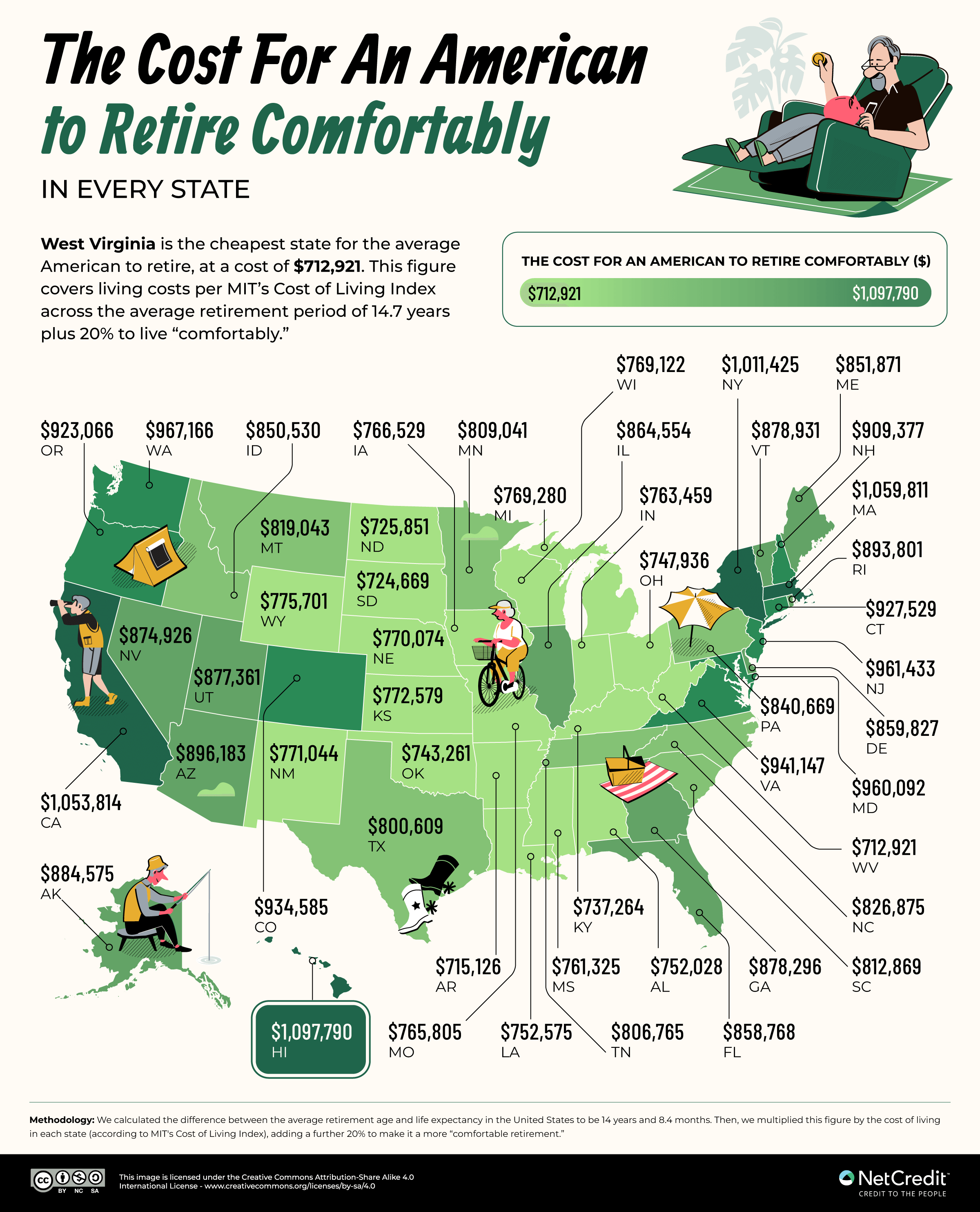

To help, NetCredit identified the cost for the average American to retire in every state, considering the varying cost of living around the country. However, our research revealed that the U.S. is one of the most expensive countries in the world in which to retire. So, with many considering the option to retire abroad, we also figured out the cost for Americans to retire comfortably in every country in the world based on the average American retirement age and life expectancy.

Retirement calculator

The key to retirement planning is to identify your savings needs, risks and strategies as soon as possible. Enter your figures to find out where you’re at and what you can expect at your present rate of saving — you can use the information tabs for guidance on any figures you’re unsure of.

How much does it cost to retire?

To determine the cost of retirement in each state and around the world, we first calculated the difference between the average retirement age and life expectancy in the United States to be 14 years and 8.4 months. Then, we multiplied this figure by the cost of living in each country and U.S. state (according to Numbeo’s Cost of Living Estimator and MIT’s Cost of Living Index), adding 20% to make it a more “comfortable retirement.” Please note that our figures apply specifically to American retirees based on local retirement age and life expectancy.

Report findings

- Singapore is the country where it would be most expensive for the average American to retire, at a cost of $1,146,232.

- The cost for the average American to retire in the U.S. is $737,997 — the fifth-highest figure for any country.

- Within the U.S., West Virginia is the cheapest state to retire — costing an average of $712,921.

- Hawaii is the most expensive state to retire to ($1,097,790).

The four countries where retirement costs more than in the U.S.

First, we used Numbeo’s Cost of Living Estimator to find the average cost of retiring in every country for 14 years and 8.4 months — including a premium of 20% to make that retirement comfortable. We found that Singapore is the most expensive country, requiring retirement savings of $1,146,232. Despite the overall expense of retiring to Singapore, the Southeast Asian country and city-state remains an attractive prospect due to its hi-tech, universal healthcare coverage, low crime rate and diverse expat community.

Singapore is followed by three European countries: Iceland ($892,906), Switzerland ($858,950) and Luxembourg ($794,050). Staying put in the U.S. requires the fifth-highest level of savings ($737,997).

Six of the ten cheapest countries to retire comfortably are in Asia, particularly in South Asia. Pakistan is the cheapest, requiring savings of $187,065. Retirement for the average American in Pakistan costs just a quarter of the price of retiring in the U.S. Retiring to India ($188,901), Bangladesh ($189,625) or Nepal ($214,396) is not much more.

“We live nicely in a way that I would have to have much more to live like this in the US,” says Albert Greenwood, who retired to Nepal from New York in 2023 and enjoys not just the reduced costs of healthcare, food and rent but using his retirement to travel around Asia. “But I know not everybody has success with these moves. If you have a big family, you miss them, and maybe that’s going to be a problem.”

Retirement costs by state reveal West Virginia as cheapest U.S. location

Next, we used MIT’s Cost of Living Index to figure out the savings the average American needs to retire comfortably in each state. We found four states where you’d need upwards of one million dollars to retire: Hawaii ($1,097,790), Massachusetts ($1,059,811), California ($1,053,814) and New York ($1,011,425).

The surroundings, climate and laid-back culture of Hawaii hold obvious appeal for retirees, but the island state consistently places as the state with the highest cost of living. However, while housing is among the top expenses in Hawaii, retirement can be an ideal moment to downsize and free up some cash — and note that those who live full-time in Hawaii may enjoy reduced property taxes.

Landlocked, largely rural states occupy several positions among the cheapest states to retire. West Virginia is the cheapest of all, with savings of $712,921 needed for a retirement of 14 years and 8.4 months. The Mountain State has excellent air, scenic living and a wealth of popular retirement destinations. Some 21% of the population is over 65, the third highest figure for any state, although some retirees will see this as a pro and some as a con — likewise, the picturesque but cold snowy winters.

How to save for your retirement

The ideal retirement savings account for maintaining your present quality of life, allowing for sudden shocks such as poor health, ongoing care needs or the loss of income due to a change in marital status. As such, it is essential to identify how much you need to save for retirement and how you intend to do so. Following these tips can help make it manageable.

1. Set your goals

Use our calculator for ballpark guidance and consult with a professional to identify how much you are likely to need across your retirement. Remember, you may need to save more if you have extensive plans beyond ‘maintaining your lifestyle,’ such as travel or further education and should you live beyond your present life expectancy.

2. Appraise your situation

Figure out exactly how much you presently have and your future earning prospects. Do you own property and other valuable assets? When will your mortgage be paid off? Do you expect an annual raise at work? Is your job secure — and do you have prospects for promotion or a higher-paid position elsewhere?

3. Make a plan and keep to it

Automate your savings by arranging monthly transfers to your savings account and pension plans around payday. This will help you to budget for your needs regularly. You can make things easier by spending strategically with money-saving tips, price comparisons and smart financing.

4. Utilize Employer-Sponsored Plans (ESP)

Check what plans your employer offers to reduce costs and enjoy tax breaks. Pay into your work pension plan or 401(k) and consider whether it would be advantageous to take on other pension plans, such as an Individual Retirement Account (IRA) or investments. Try to avoid withdrawing your pension savings ahead of time. The Department of Labor suggests that if you get a new job, you should “leave your savings invested in your current retirement plan, or roll them over to an IRA or your new employer’s plan.”

5. Enjoy your money

It may not always seem easy to take money lightly, but recognizing the hard work you put into saving and everyday spending can make it seem worthwhile. Visualizing the benefits of your retirement savings also keeps things in perspective. “Seeing the life you want to live in detail can incentivize you to save more in order to live that life,” says Mark Hebner, CEO of Index Fund Advisors.

Tailoring your retirement plan

“Having a specific percentage or dollar amount savings goal can be helpful, but you can’t be focused solely on that,” says Ben Storey, Bank of America’s director of Retirement Research & Insights. “Everybody’s lifestyle is different, and how they spend their retirement may be very different as well.”

Variables include your age now and when you plan to retire, life expectancy based on family history, specific work or travel plans for the retirement years, and where you expect any ongoing income to come from. To help you navigate, we’ve gathered the data from the maps above into this interactive and searchable table.

However, one of the fundamental variables is the moment at which you start planning your retirement finances. And for most adults, the sooner that moment comes, the better.

Methodology

To identify the cost for an American to retire comfortably in every country and state, we first considered the average retirement age and life expectancy in the United States.

By calculating the difference between these figures, we calculated an average of 14 years and 8.4 months to live post-retirement.

We then multiplied this figure by the cost of living in each country and state, adding 20% to make it a more “comfortable retirement.”

We determined the cost of living by country using Numbeo’s Cost of Living Estimator and aggregating the data for all cities by country in the dataset.

We used the following parameters:

– Currency: USD

– Household members: 1

– Eating lunch or dinner in restaurants: 20%

– Choosing inexpensive restaurants: 70%

– Drinking coffee outside the home: Moderate

– Going out: Once per week

– Smoking: 0

– Alcoholic beverages: Moderate

– At-home eating habits: Western cuisine

– Driving a car: Moderate

– Taking taxis: No

– Public transport: 2 round trips weekly

– Sports memberships: All household members

– Vacation and travel: Twice per year

– Buying clothes and shoes: Moderate

– Rent: Apartment (1-bedroom) in city center

– Children: None

For the cost of living per American state, we used MIT’s Cost of Living Index.

The data was collected in February 2025.

DISCLAIMER: This content is for informational purposes only and should not be considered financial, investment, tax or legal advice.