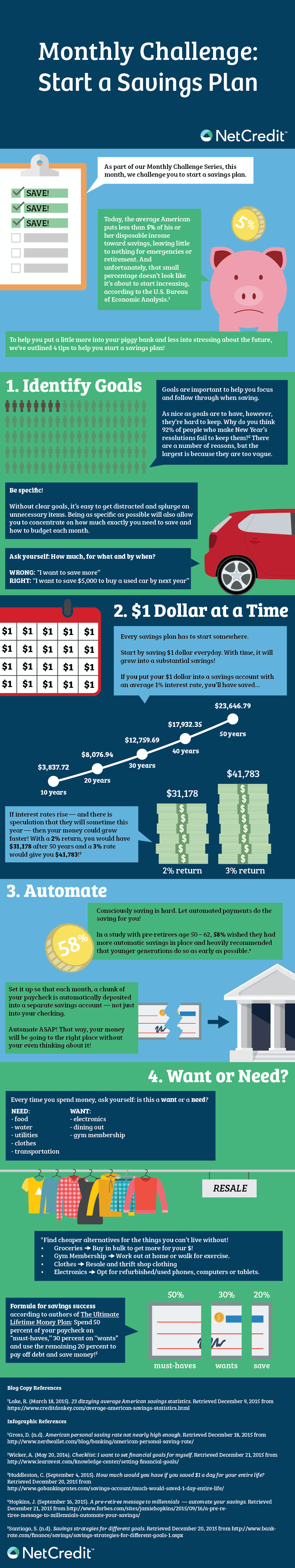

Saving money is always challenging for one reason or another. Whether it’s from limited funds or a lack of self-discipline, setting aside money for savings is hard and, sadly, a staggering amount of us don’t have any to fall back on. To put it in perspective, approximately 26% of adults have no savings set aside for emergencies, while 36% have yet to start saving money for retirement.1

What better time to take a close look at your savings plan than at the start of the new year? This month, as part of our Monthly Challenge Series, we challenge you to start a savings plan.

Embed This Image On Your Site (copy code below):