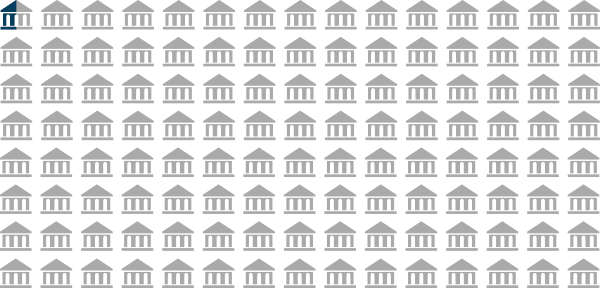

We all felt it. In fact, many of us are all still feeling the effects of it even now almost a decade later. The impact of what is now called the Great Recession of 2008 still reverberates today. Home values fell off a cliff, waves of foreclosures hit the market and the unemployment rate topped 10 percent for the first time in nearly 25 years. 2008 initiated a very bad period for the U.S. economy. How bad was it?

What is a recession?

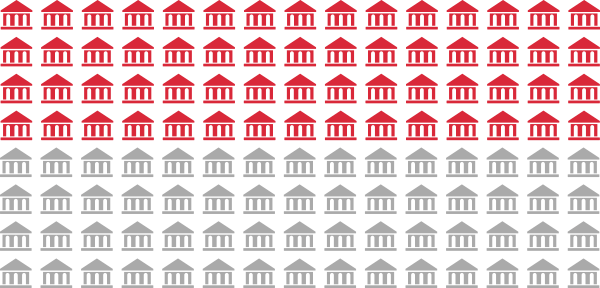

Officially, our economy is in a recession when the Gross Domestic Product (GDP) shrinks for two consecutive fiscal quarters. The GDP is the total market value of all goods and services produced. Unofficially, however, a recession can simply be described as an extended period of sluggish economic growth and a reduction in economic activities.

Tracking the GDP gives economists a measure on how the U.S. economy is performing as a whole. When the GDP shrinks — what economists call “negative growth” — the economy is moving backward, not forward. However, a one-quarter shrinkage in growth could be a statistical anomaly. It takes two consecutive quarters of negative growth (that’s six months) to convince economists what most consumers usually already know: The economy is in terrible shape.

In economic terms, a depression is a very severe recession. Here are the two ways we technically define the tipping point between a recession and a depression. Only one needs to be met to report a state of depression: