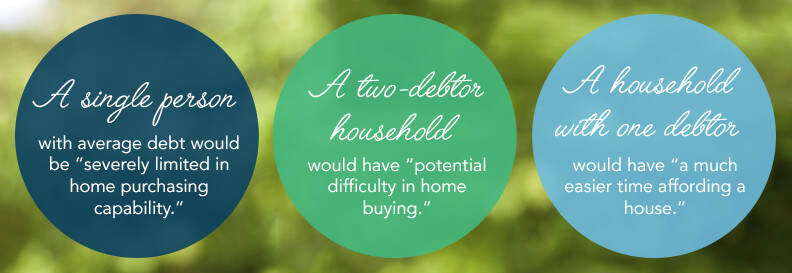

A house, 2.5 kids and a white picket fence: It’s the classic American dream. But with the cost of a four-year degree rivaling (if not surpassing) the cost of a modest home, some fear that young America’s ability to attain those decades-old aspirations could be threatened.

A report by Young Invincibles, a policy resource organization, recently looked at how rising student debt levels affect the young college graduate’s ability to buy a home. As the study points out, one of the primary measurements that determine whether or not an individual qualifies for a mortgage is the debt-to-income ratio, or DTI. In the past, mortgage lenders were often more willing to offer some flexibility on DTI when student loans were involved. However, the recent economic and mortgage crisis has forced most mortgage loan providers to tighten their DTI requirements so as to better ensure that prospective loan borrowers can actually afford their loans.

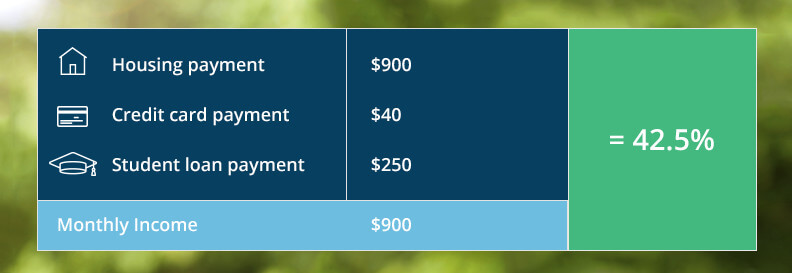

More specifically, lenders generally calculate the back-end debt-to-income ratio, which provides a complete overview of the borrower’s total long-term obligations — and that person’s ability to adequately handle those debts. Mortgage lenders typically review two DTI calculations: the front-end and back-end debt ratios. The front-end looks at the borrower’s housing payments, particularly the projected PITI (mortgage principal, interest, tax and insurance) payments, as well as related expenses such as condo dues and homeowner association assessments.

In contrast, the back-end DTI ratio adds all other long-term debt obligations to the front-end calculation. It takes three groups of consumer finance factors into account: