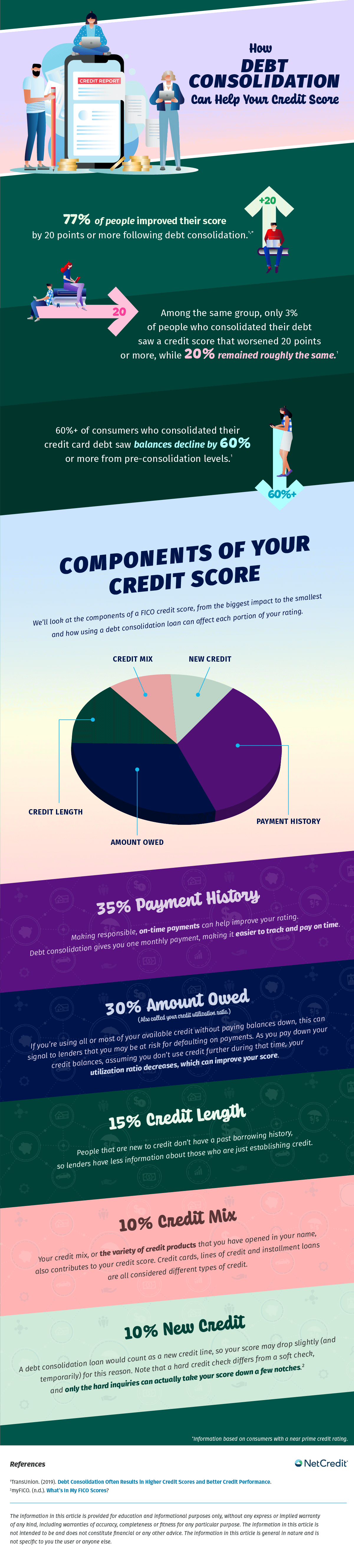

Strategic debt consolidation is a common and effective way for many Americans to help manage and eliminate debt. In addition to making one consolidated repayment, you might get a lower APR (annual percentage rate) and/or lower monthly payment in the process. But if you’re considering the debt consolidation route, you might have concerns regarding how the process can affect your credit score.

The good news is that, while there are many factors that ultimately determine your credit score, a debt consolidation loan can actually help improve your rating if you’re holding up your part of the deal, like making on-time payments, and keeping your credit utilization ratio low (we’ll cover more on that later). If you’re able to pay beyond the minimum payment, there may be more benefits. Some lenders won’t charge an early repayment fee, saving you on interest and shortening the amount of time it takes to repay your loan. It’s another way you can be in control of your loan and personalize it to your needs.

Before you select a specific loan to consolidate your debt, make sure you compare the interest rate as well as how long you have to pay it off. You’ll need to consider the duration of the loan as well as the interest rate to determine whether your total amount repayable will be more or less than your current debt scenario. Remember that the longer the duration of the loan, the more interest you will pay in total.

Check out what debt consolidation can do for your credit score.

*Information based on consumers with a near prime credit rating.

References

1TransUnion. (2019). Debt Consolidation Often Results in Higher Credit Scores and Better Credit Performance.

2myFICO. (n.d.). What’s In My FICO Scores?.

The information in this article is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness or fitness for any particular purpose. The information in this article is not intended to be and does not constitute financial or any other advice. The information in this article is general in nature and is not specific to you the user or anyone else.

Embed This Image On Your Site (copy code below):

DISCLAIMER: This content is for informational purposes only and should not be considered financial, investment, tax or legal advice.