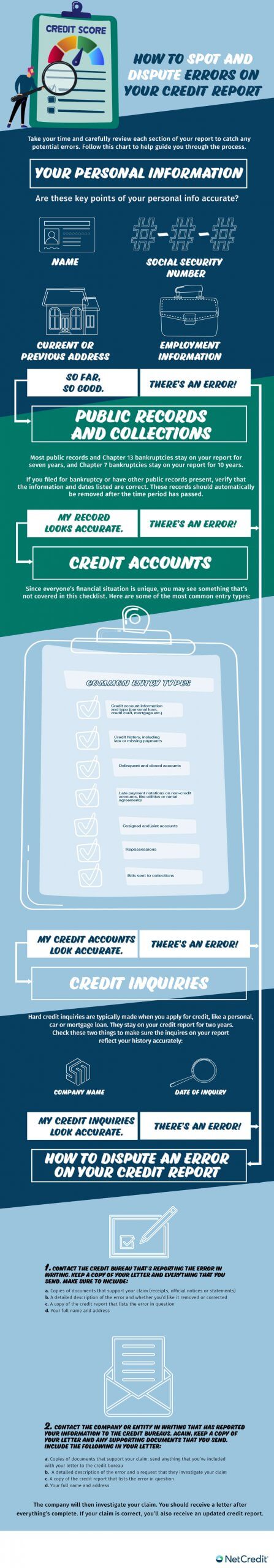

Looking to improve your credit health? Responsible credit management means more than just periodically checking your scores. You should be reviewing your full reports from each of the credit bureaus to ensure the accuracy of your information. Under the Fair Credit Reporting Act, credit reporting agencies as well as the companies supplying information to them are responsible for maintaining accurate, verifiable information. Incorrect or unsubstantiated data can be disputed and removed from your report.

Not sure where to start? We’re here to help you access, review and dispute any incorrect information you might see on your credit reports.

Your first step is to access a free copy of one, two or all three reports from the major credit bureaus. Staggering your reports can help you strategically manage your credit since you only get one free report from each agency per year. Just request what you need from annualcreditreport.com.