Do you have $600k put aside for your retirement? If you’re depending on your savings to keep you in your present lifestyle when you quit work, that’s how much you might need. Just 14% of Americans in their 40s and 50s have more than half a mil put away – and if you’re in a similar position, you could enjoy a fuller retirement in a more affordable country.

There are many good reasons your retirement fund could be low. Sadly, the lockdown has forced nearly one-third of Americans to slam the breaks on their retirement savings. In fact, around 9% have withdrawn from their savings just to get by. Even if your savings remain untouched, you might have underestimated what you’ll need to get by or lack the income to save comfortably.

Whether you’re on track to save what you need or not, retiring abroad is a handsome option. Retirement is an opportunity to learn new things, gain new experiences and meet new people. And many places are much cheaper to live in retirement than the US.

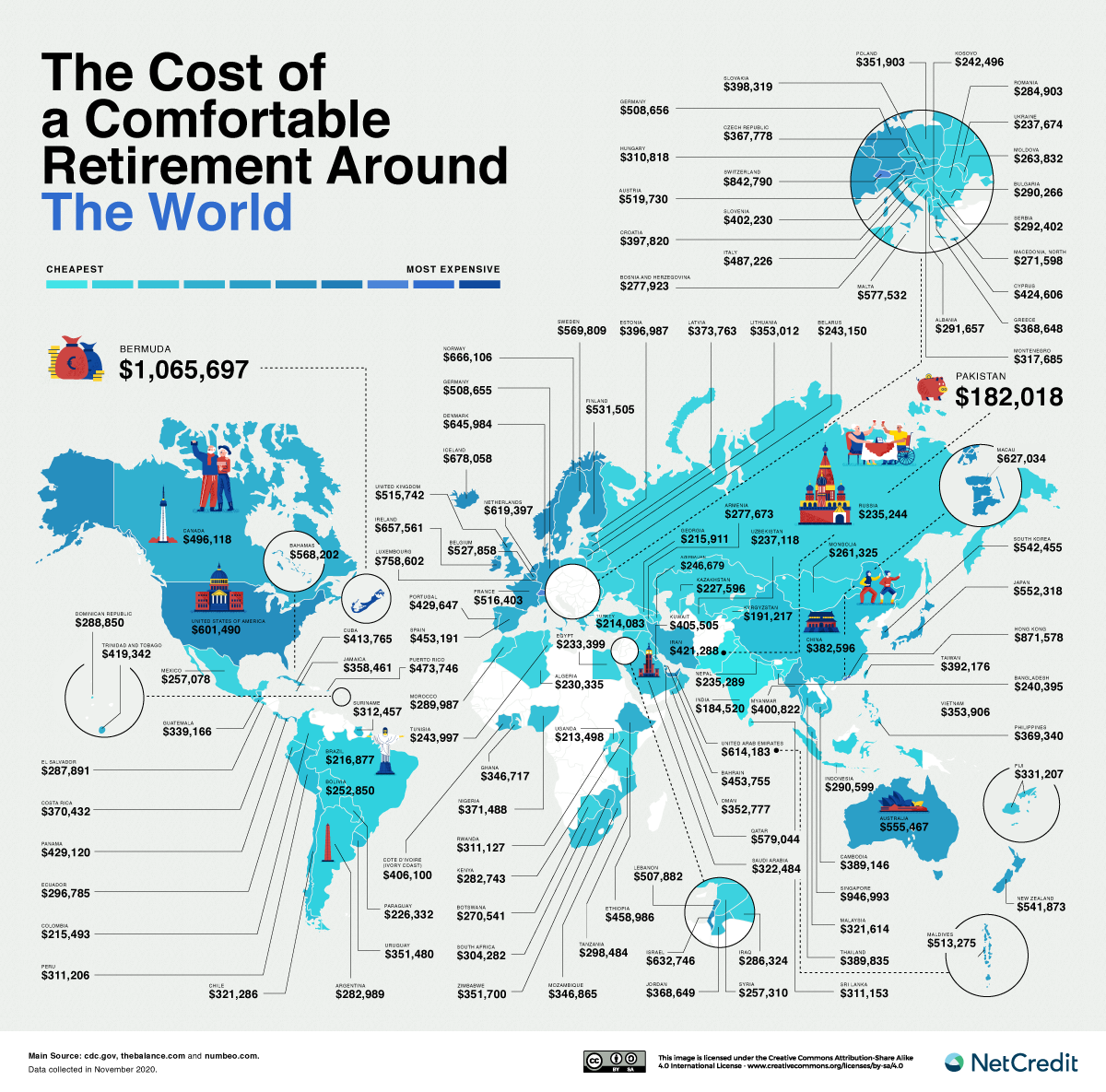

For our latest study, we figured out that to retire at the average age in America (64) with the average life expectancy (78.7) you’d need around $601,489 in the bank. We applied the same calculations to every country on Earth to see how much a 64 year old would need to maintain the same quality of life: going out once a week, takeout coffee once a week, no smoking, moderate drinking, no taxis or rideshares and two vacations, among other controls.

The result is a series of maps of the most affordable places to comfortably retire around the world.

Key Findings

- The most expensive country in the world to retire is Bermuda, where you would need $1,065,697.

- Pakistan is the cheapest country to retire. You would need $182,018 to maintain our example lifestyle there.

- Fourteen years of retirement in the US would cost $601,489.63 according to our metric: $40,917.66 per year or $2,841.50 per month.

- We found 125 countries where retirement is cheaper than in the US and only 13 that are more expensive.

Bermuda is the Most Expensive Country for Retirement

Click here to see the map in full size

Depending on who you ask, Hong Kong and Switzerland are touted as the most expensive places to live. We found them to be the third and fourth priciest for retirement. Bermuda prices are targeted at those with lives of leisure. Restaurants in Bermuda are twice as expensive as in the US, and the capital, Hamilton, is known as the world’s most expensive city.

And the most affordable country? Pakistan is cheap across the scale. Only on utilities does the Asian country cost more than other cheaper destinations – twice the cost of utilities in India, but less than half the cost in the States. A Pakistani retirement would cost you $182,018.34, which is $10,318.50/year or $859.88/month.

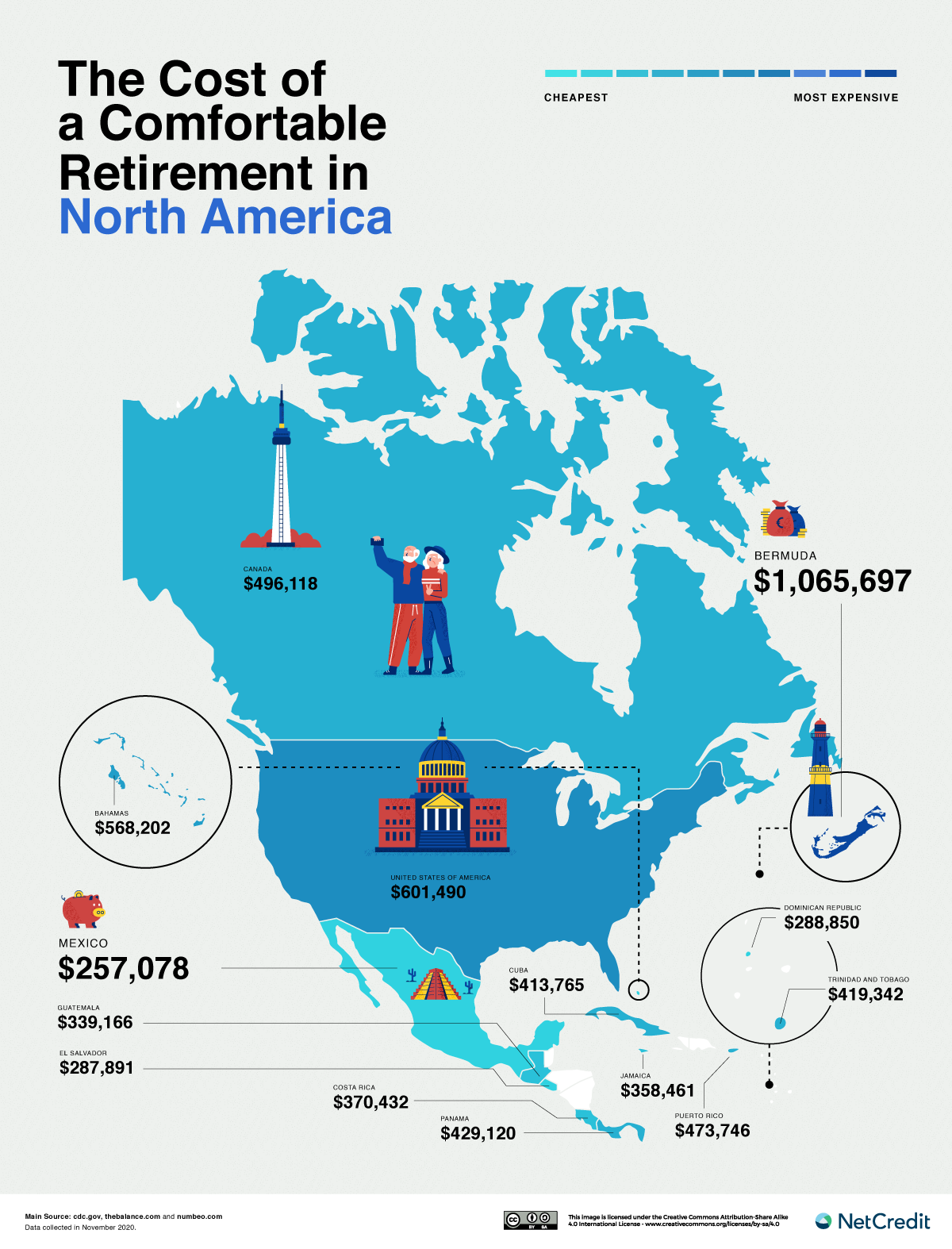

North America

Click here to see the map in full size

In the United States, we calculated a base cost of $601,490, making it the second-costliest in North America, beaten only by Bermuda. Canada is significantly cheaper at $496,118 – a saving of $12k a year between the ages of 64 and 78.

Mexico is the cheapest place in North America, at the cost of $257,078. This is nearly a quarter of the cost of retiring in Bermuda. But if you’re hooked on the idea of retiring to paradise, the Bahamas is an option at $568,202 – $8k/year cheaper than the US.

South America

Click here to see the map in full size

South America provides many more affordable retirement options than the north of the continent. Even the most expensive country, Uruguay, is nearly half the cost of the US. You would need savings of $351,480 to land here.

Brazil and Colombia are neck-and-neck to be the cheapest retirement destinations in South America:

$216,877 and $215,493 respectively. If you’re planning on owning a car, it could end up cheaper for you in Brazil, while taxis are slightly cheaper in Colombia.

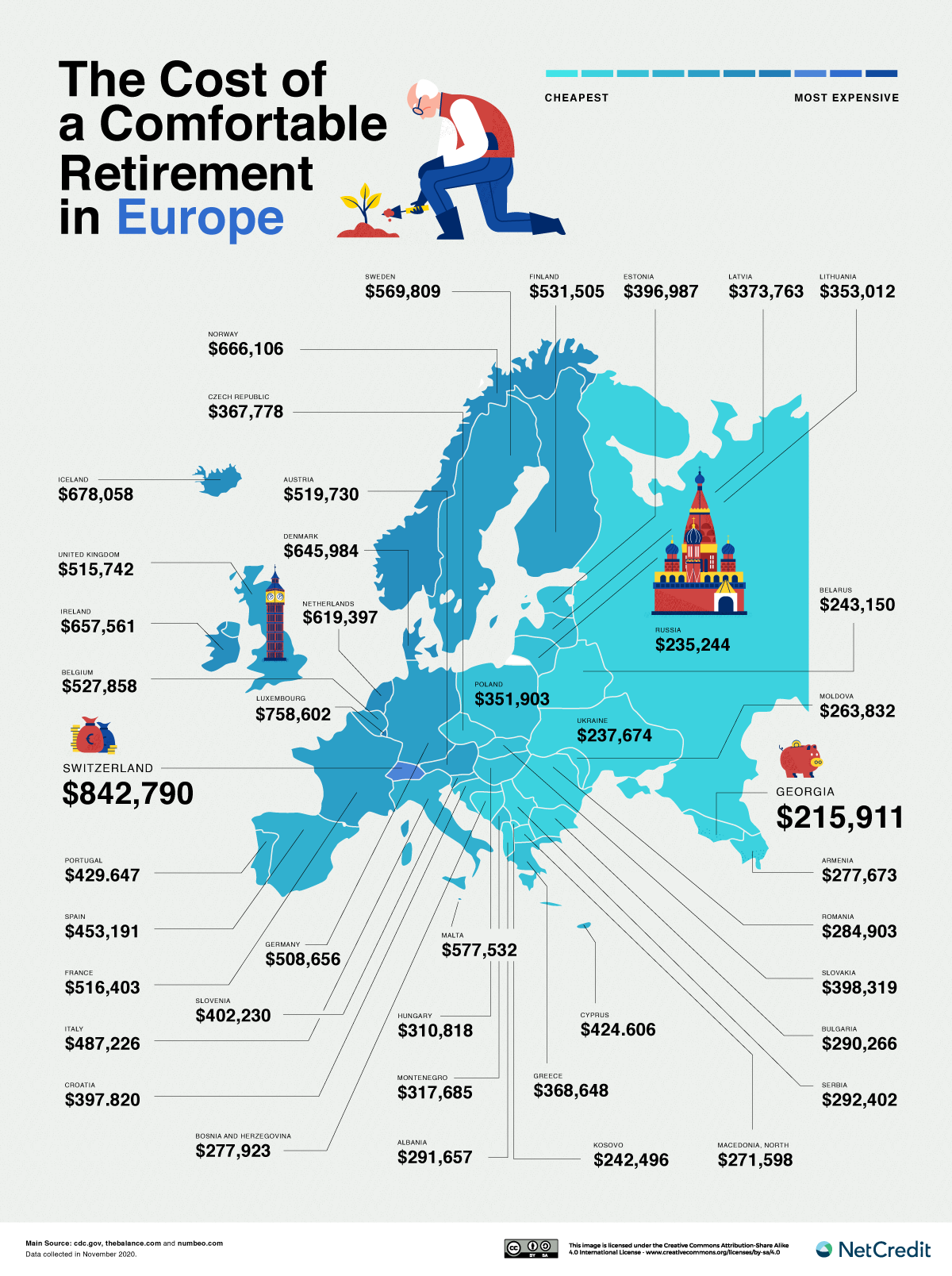

Europe

Click here to see the map in full size

The financial centers of Switzerland and Luxembourg are known as pricey places to be. Both offer ‘fairytale-like’ landscapes and histories that appeal to lettered American Europhiles! However, since their $842,790 and $758,601 price tags eclipse the cost of an American retirement, you can probably find somewhere more affordable to your tastes by venturing east.

East, for example, is Georgia, a beautiful country with a rich culture and history and a retirement cost of $215,911 – just over one-third of the US price. Georgia is the cheapest retirement destination in Europe, followed by its neighbors Russia and Ukraine.

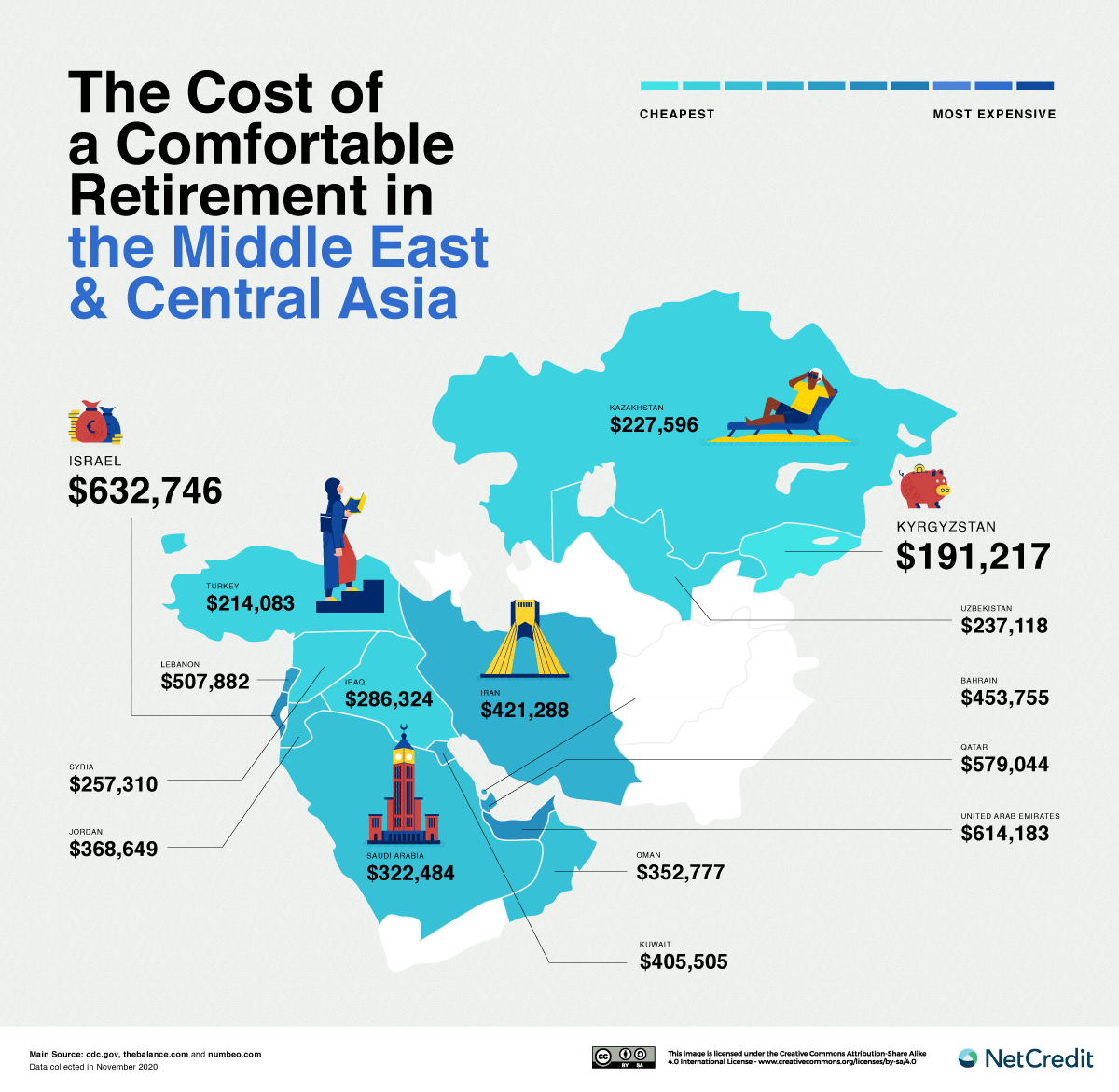

Middle East and Central Asia

Click here to see the map in full size

Israel is the most expensive part of this region for retirement, and a little more expensive than the US at $632,745. Owning a car here will cost you twice what it costs in the States, but if you can do without a car, then Israel starts to become an option.

Central Asia is home to some of the cheapest places to retire: the ‘Stans (Kyrgyzstan, Kazakhstan, Uzbekistan) each come in below a quarter-mil, with Kyrgyzstan ($191,216) being the third-cheapest country in the world for retirement.

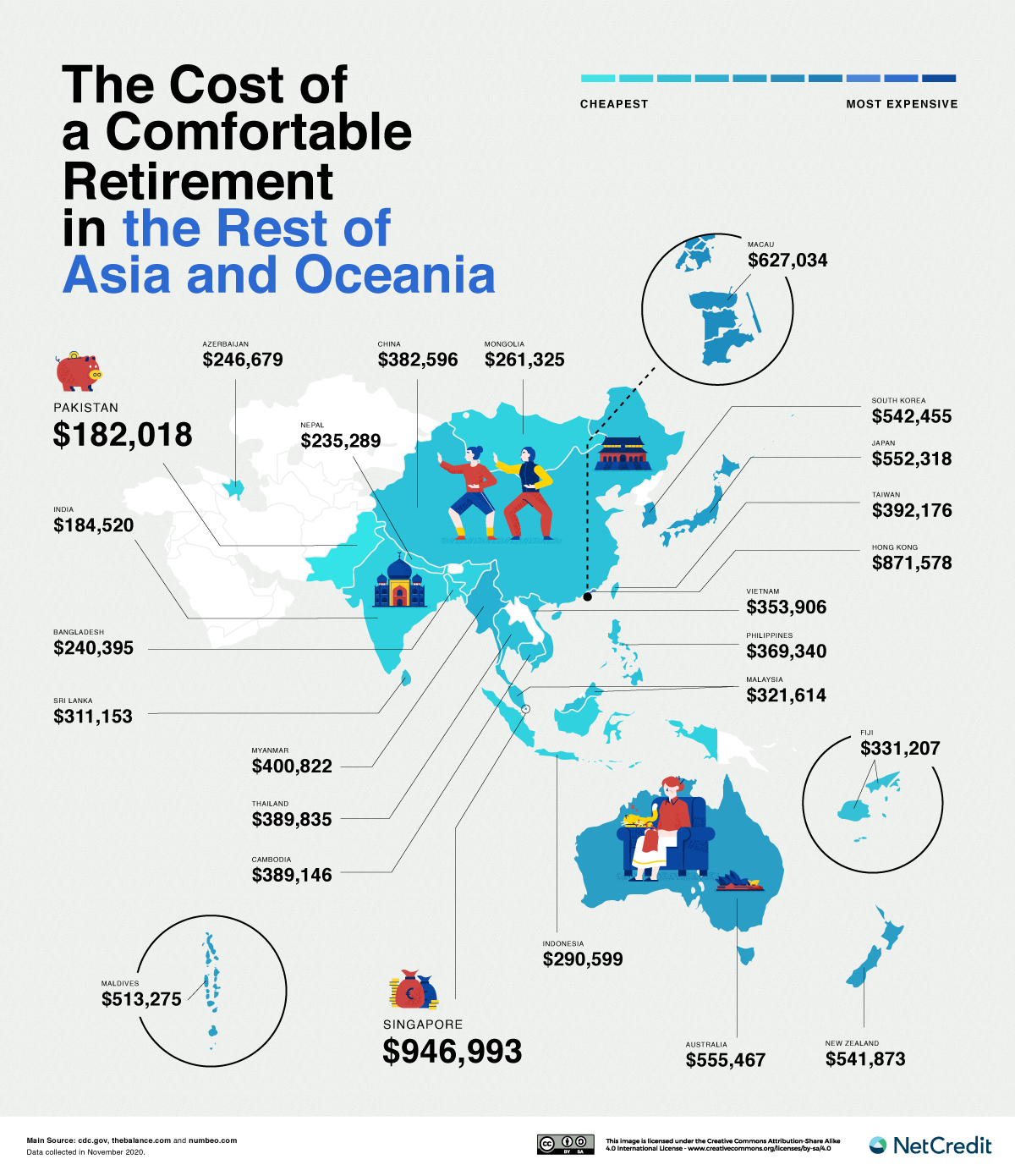

Rest of Asia and Oceania

Click here to see the map in full size

Only three countries in this region are costlier for retirement than the US. Singapore and Hong Kong are the second and third most expensive in the world. The other pricey destination in this region is Macau, which, like Hong Kong, is a Chinese Special Administrative Region with its own economic system. A retirement in Macau costs just $120/month more than in the US.

This region is also home to the cheapest destinations in our study: Pakistan ($182,018) and

India ($184,519). The average cost of living in Pakistan is 69.74% lower than the US, and the average rent is 89.26% lower. However, India has proved an attractive destination for expat retirees in recent years due to the sights, beaches and community.

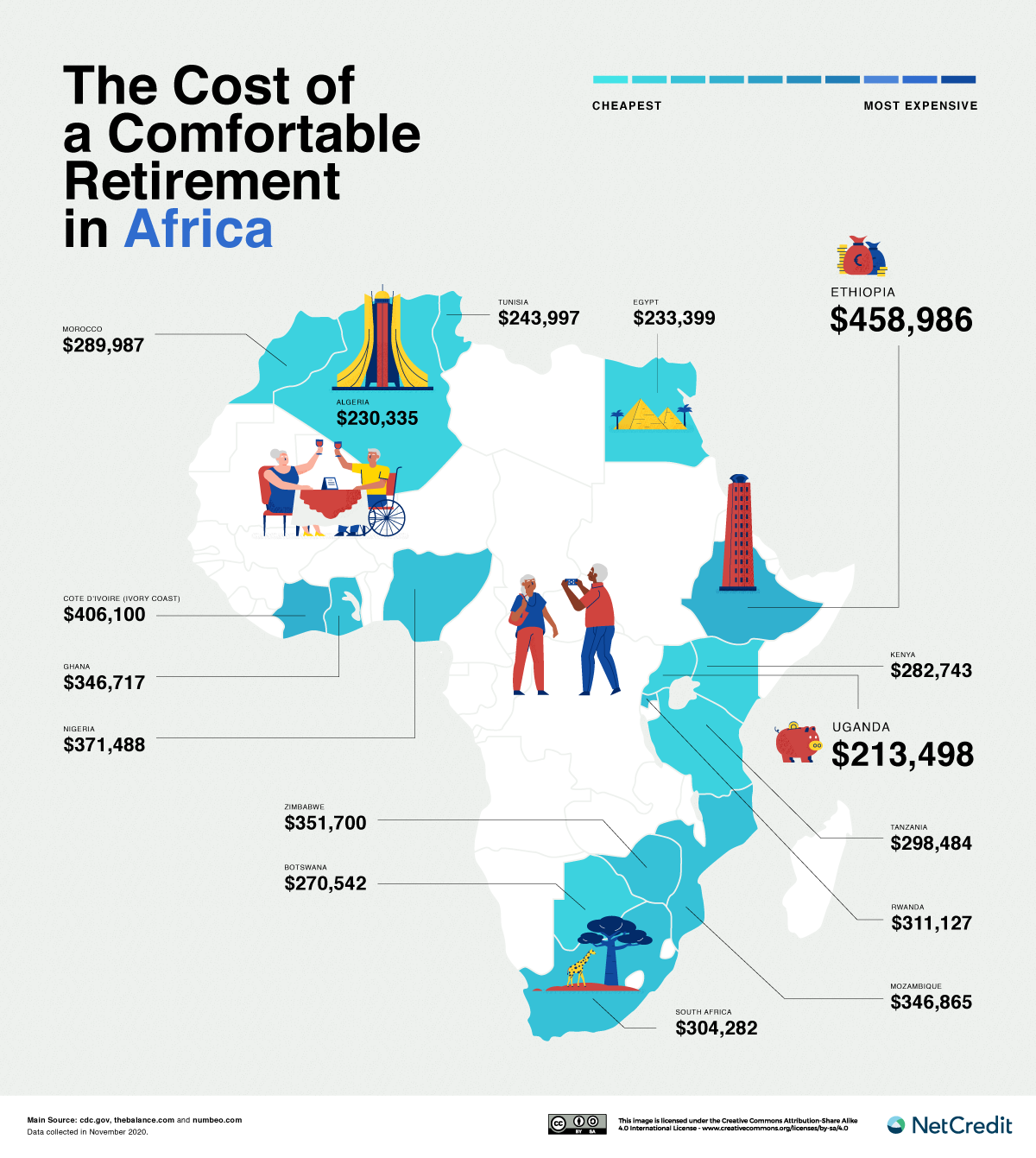

Africa

Click here to see the map in full size

It would be cheaper to retire to any country in Africa than to stay in the US. Africa’s most expensive destination for retirees is Ethiopia, at $458,986. Tourism is on the rise in Ethiopia, and recent economic and social reforms have encouraged the diaspora and foreigners alike to consider here.

Three of the five cheapest destinations on the continent are in North Africa. Algeria, Egypt and Tunisia each cost a little shy of a quarter-million dollars. The cheapest on the continent is Uganda, at $213,498. But South Africa is a more popular retirement destination and still costs just $304,282 – almost half the price of an American retirement.

Retiring Abroad: A Win-Win Situation?

Many Americans are struggling to save enough for their retirement, and current economic conditions aren’t helping.

The rather blunt solution provided by Olivia S. Mitchell, executive director of Wharton’s Pension Research Council at the University of Pennsylvania, is to keep working. Even continuing part-time work until you’re 70 – at which point Social Security benefits jump 76% – can make things more manageable. If you’re sick of your job, consider retraining. This will help keep your mind nimble and your brain and body healthy as you approach your vulnerable later years.

But travel is another way to stay sharp and inspired – and it sure beats working for a living. If you have a few years or decades to go until you hang up your work overalls, why not start researching some of the more affordable retirement destinations in our study?

Financial Options for Emergencies.

Surprise expenses can pop up anytime — even during retirement. They can put a strain on your finances if you’re trying to stick to a budget. However, you have options for times when you need to cover additional expenses.

Savings or Extra Income.

Sell items you no longer need. A quick way to earn some extra cash is to sell items you no longer need. This can include things like clothing, electronics, tools, musical instruments or furniture. There are many places online that you can list your items or you can find local consignment stores in your area.

Pick up some side work. If your schedule allows, you can earn extra money through things like a part-time job, freelance work or even things like pet sitting. A few extra hours a week can help you cover any additional expenses that come your way.

Use your emergency fund. If you have an emergency fund, this is when you’d use it. You can dip into it to help you cover unexpected costs so you don’t have to rely on borrowing. If you don’t have an emergency fund, building one can help you stay prepared for the next surprise.

Ask family and friends. Asking to borrow money from family or friends can be intimidating, but it’s often a better option than taking on debt from a financial institution. Your support network is likely going to allow you more flexibility with repayment and they likely won’t ask you to pay interest. Just be sure to keep communication open and lay out a clear repayment plan to avoid putting strain on your relationships.

Borrowing

If other options aren’t available, it may be time to consider borrowing the funds you need. Borrowing can help you get the quick cash you need in an emergency, but it’s important to carefully consider your situation and be sure you understand all your options before making a decision.

Credit cards. Credit cards can offer immediate access to funds, but carrying a balance from month to month can mean you’re building up interest charges and increasing your utilization ratio can affect your credit score. Additionally, credit cards may not be an accepted form of payment in some situations.

Personal line of credit. A personal line of credit can also offer you access to funds when you need them. It’s a form of revolving credit, similar to a credit card, though instead of purchases being charged to an account, funds are drawn and deposited into your account to use as cash. Knowing the difference between a credit card and line of credit can be helpful when deciding which one to use.

Personal loans. A personal loan provides an upfront lump sum of money that you can use to cover expenses. You’ll then repay the loan in smaller installments over a fixed repayment period. They can be useful in emergencies, but be sure to read all the terms and conditions before signing. Interest rates vary by lender and can be high — especially for those with bad credit.

METHODOLOGY & SOURCES

Our calculations are based on the average American retirement age of 64 years and the average American life expectancy of 78.4 years. Calculations of monthly living costs were completed in USD using Numbeo based on the following assumptions:

- Members of your household = 1

- Eating lunch or dinner in restaurants = 15%, Choosing inexpensive restaurants = 70%

- Drinking coffee outside your home = moderate

- Going out = once per week

- Smoking = no, Alcoholic beverages = moderate

- At home, we are eating = Western

- Driving car = moderate, Taking taxi = no

- Public transport = 2 round trips weekly

- Sports memberships = all household members

- Vacation and travel = two per year

- Buying clothes and shoes = moderate

- Rent = Apartment (1 bedroom) in city center

- No children

Monthly living costs were collated for 124 countries, then multiplied by 176.4 = 14 years and 8.4 months between retirement age and life expectancy. To allow for a more comfortable retirement, the figures were further revised up by 20%.

Since Numbeo data is fully user-generated, it’s skewed towards capitals and big cities, which might account for the cost-of-living estimates in certain countries appearing inflated. Note that Numbeo cost estimator doesn’t include insurance, health-related expenses and doesn’t account for income tax in different countries.

Cost-of-living figures on Numbeo are updated regularly and may not fully correspond to the figures in the dataset, which were accurate at the time of data collection (November 2020).

Sources:

Life expectancy – Center for Disease Control and Prevention

Typical retirement age – The Balance

Living costs – Numbeo Cost of Living Estimator

DISCLAIMER: This content is for informational purposes only and should not be considered financial, investment, tax or legal advice.